Survey: Over Three-Quarters of Executives Believe Their Businesses Will Be Equally or More Profitable in 2020

- Published

- Dec 16, 2019

- Share

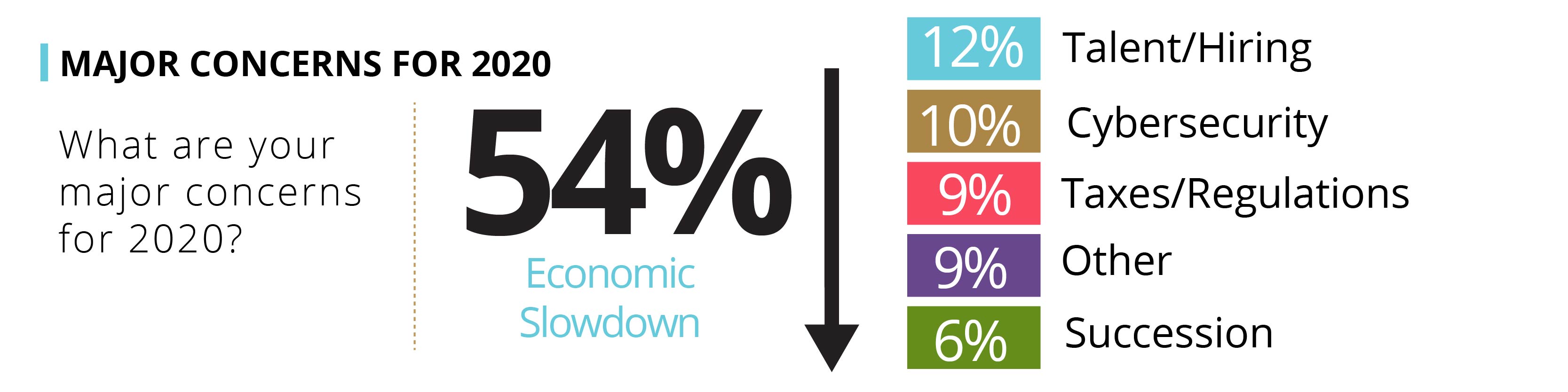

While Biggest Concern for Most Is an Economic Slowdown

Business leaders remain bullish about their businesses on several levels for 2020, including overall profitability. But they also have a real fear of a possible economic slowdown. Those are a pair of key findings from EisnerAmper’s executive survey, which gauged the outlook of hundreds of business leaders throughout the Northeast and South Florida regions.

Methodology

The online and in-person survey was taken by approximately 940 business owners, C-suiters, family office executives, and high net worth individuals at the annual EisnerAmper Business Summit Series held from October 29 through November 13 in New York City, New York; Westbury, Long Island; Philadelphia, Pennsylvania; Miami, Florida; and Edison, New Jersey.

The bulk of attendees (40%) are in financial and professional services, with representation from other sectors such as health care, technology, manufacturing and real estate. Most companies fall in the annual revenue range of $50 million to $500 million. The Summit Series offers attendees an interactive learning and networking environment covering the latest trends in areas like capital investment, technology, staffing, mitigating risk and succession planning.

Profitability and Major Concerns

A total of 76% of respondents say their businesses will be “just as” or “even more” profitable in 2020 than they were in 2019—with the single largest category being 55% who indicated “more.” Only 9%,  the lowest amount, feel their businesses will be less profitable. In each of the geographic locations surveyed, the second largest response across the board for 2020 was “equally profitable.”

the lowest amount, feel their businesses will be less profitable. In each of the geographic locations surveyed, the second largest response across the board for 2020 was “equally profitable.”

Respondents’ biggest concern for 2020 is an “economic slowdown,” at 54%. Included among the list of biggest concerns is talent/hiring (12%), the often-publicized issue of cybersecurity (10%), taxes/regulations (9%), succession planning (6%), and other (9%).

Note: A subset of the same demographic, at the same event, was asked three additional questions:

Product and Service Sourcing

With the global economy undergoing trade wars and increasing protectionism, Summit attendees were asked how confident they are in securing goods and services from abroad. Despite the current geopolitical landscape, 42% responded “somewhat” or “very” confident of access to overseas goods and services. Only 19% indicated “less” or “not at all” confident. The largest single number was 39% who said that overseas sourcing does not apply to their businesses.

Employee Compensation

When asked about their expectations of employee compensation for 2020 as a percentage of budgets, a majority of 58% answered it will increase “strongly” or “moderately” over 2019 levels. Only 3% said it will decline “moderately” or “strongly.” A significant number, 39%, feels it will stay the same.

Impact of Artificial Intelligence on Hiring

While there has been much written about AI’s potential impact on staffing—some predicting it will result in mass downsizings, with others believing it will lead to the reassignment of staff to higher-level consultative duties as well as create the need for additional IT personnel, the data seems to favor the later. A total of 20% of respondents indicated AI will increase hiring levels for 2020, which was almost twice as many as those who said AI will lead to decreased hiring, 12%. The majority, 42%, however, indicated it is too soon to tell. Geographically, only Long Island individuals feel that AI will impact hiring for the worse—with nearly three times as many saying it will lead to decreased hiring as opposed to increased hiring.

“This year’s survey shows that, while business leaders recognize the risk of potential economic headwinds, the mood is overwhelmingly positive, and companies believe they are well-positioned to grow,” said EisnerAmper CEO Charles Weinstein. “However, given the concerns of a potential slowdown, it is critical that companies plan methodically and comprehensively for an uncertain year. Well-capitalized and thoughtful organizations will want to be nimble and take a strategic approach with respect to both opportunities and challenges.”