Going Public Through a SPAC: Considerations for Sarbanes Oxley (SOX) Compliance

- Published

- Dec 16, 2021

- Topics

- Share

SPACs not only have an accelerated timeline for target companies to go public compared to traditional IPOs; what many target companies do not initially realize is that they also may have an accelerated timeline for Sarbanes Oxley (SOX) Compliance. For companies going the public markets route via the traditional IPO, there is a grace period to comply with SOX during their first annual reporting period. For SPACs, this typical grace period for newly public companies applies most commonly to the date the SPAC went public, as opposed to the date the de-SPAC transaction was completed. This may be the case if the SPAC’s 8-K is amended to include the target company’s prior year financials. Once it is determined that SOX compliance and reporting is required, the question often becomes whether management or management and the company’s auditors are required to opine on the effectiveness of the internal controls over financial reporting (ICFR), respectively compliance with SOX 404a or SOX 404b.

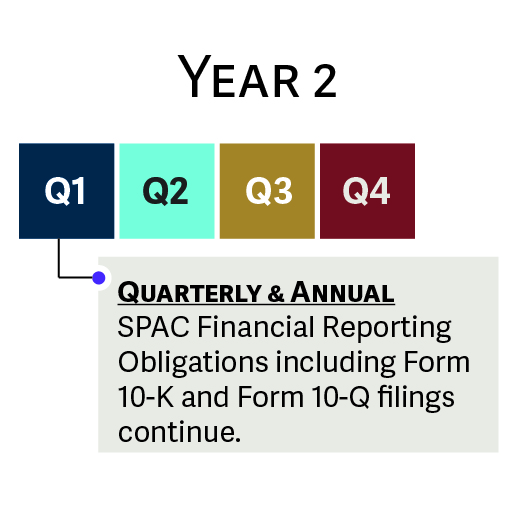

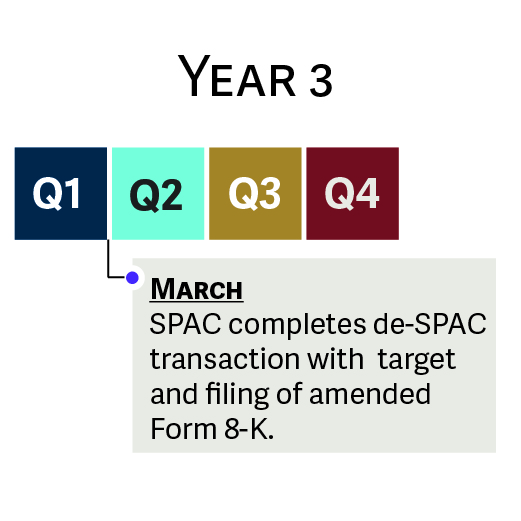

Let’s take a look at some SOX Compliance considerations for companies that have completed the de-SPAC process and a sample timeline below:

| May Be Exempt from SOX Reporting |

Management’s Attestation (SOX 404a) |

Management and Auditor’s Attestation (SOX 404b) |

|---|---|---|

|

|

|

Timeline depicting a de-SPAC transaction that may be required to comply with SOX 404a or 404b the year the transaction is completed.

What's on Your Mind?

Start a conversation with Nina