Accounting Considerations for Debt Modifications

- Published

- Dec 17, 2024

- Share

Organizations are increasingly turning to debt modifications and restructurings to alleviate financial pressures from high interest rates, strict lending requirements, impending maturity dates, refinancing complications, covenant violations, cash flow constraints, or changes in underlying collateral values.

While necessary, these actions can significantly impact an organization’s financial statements. Understanding the complex accounting implications of debt modifications and restructurings is necessary to produce accurate financial reporting.

Common Accounting Models for Debt Modification

Three accounting models apply depending on the circumstance: troubled debt restructuring (TDR), debt extinguishment, or debt modification.

Troubled Debt Restructuring (TDR)

When restructuring debt with the same lender, one must ask if troubled debt restructuring (TDR) occurred. TDR accounting significantly differs from non-TDR accounting, so organizations must understand potential discrepancies. For a debt restructuring to be considered troubled, an entity must be experiencing financial difficulties, and the lender must grant a concession.

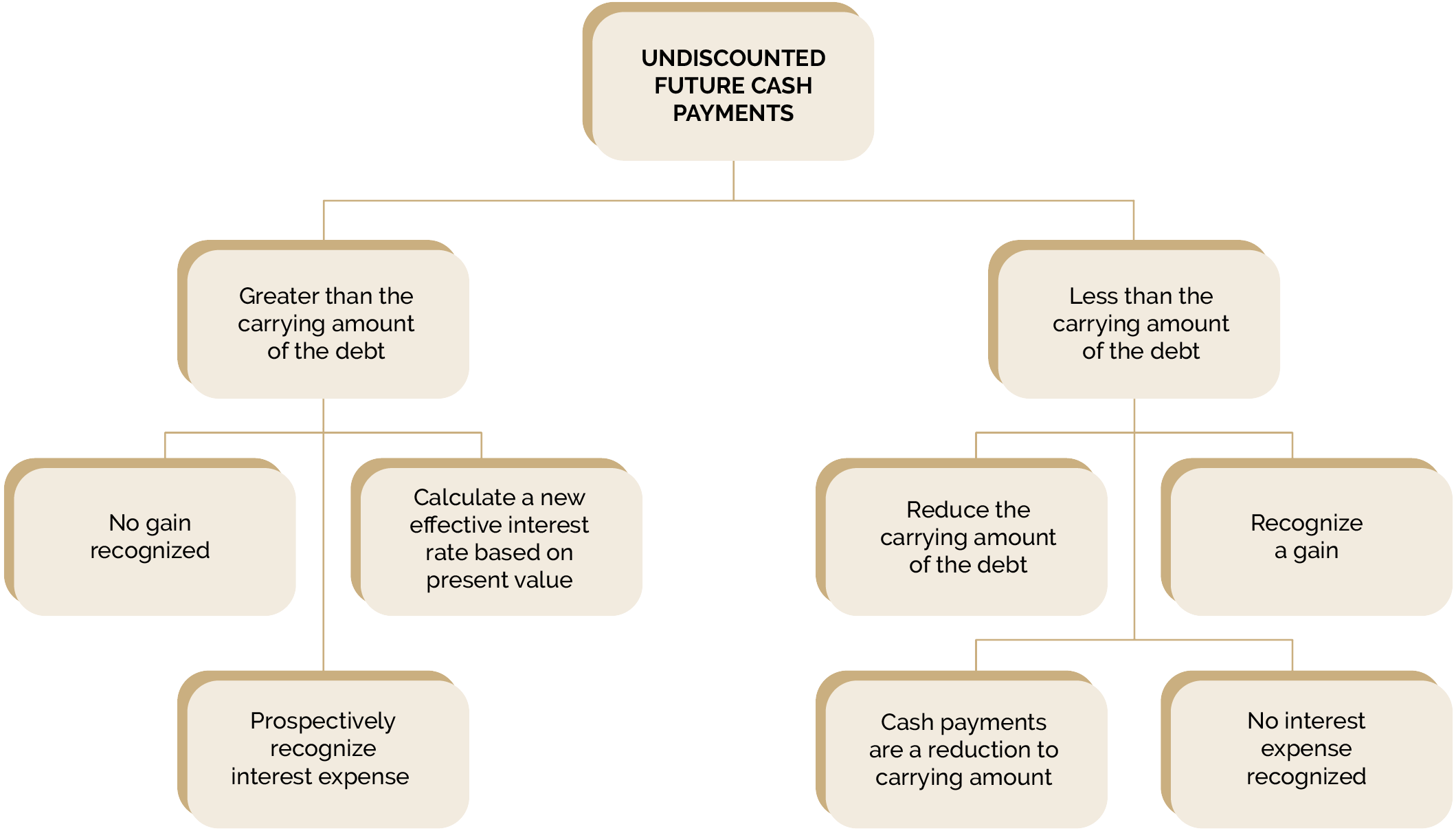

TDR modifies the terms of the debt arrangement; therefore, the accounting depends on whether the total undiscounted future cash payments specified by the new terms are greater or less than the carrying amount of the debt at the time of restructuring. Suppose the total undiscounted future cash payments are more significant than the carrying amount of the debt. In that case, the borrower accounts for the effects of the restructuring prospectively from the time of the restructuring. The borrower does not change the carrying amount of the debt; thus, no gain is recognized. A new effective interest rate is calculated by equaling the present value of the future cash payments specified by the new terms and anticipating interest expense.

If the total undiscounted future cash payments are less than the current amount of the debt, the borrower will reduce the debt to match the total future undiscounted cash payments specified by the new terms. This reduction results in a gain for the borrower due to the debt restructuring, cash payments are treated as a reduction on the carrying amount, and no interest expense is recognized.

Determining Debt Modification or Extinguishment

If the transaction is not considered TDR, the next step is to determine whether the transaction is a debt extinguishment or modification. It’s important to note that if an entity enters a debt arrangement with a different lender and satisfies its existing debt arrangement with the original lender, that transaction is accounted for as an extinguishment of the existing debt and an issuance of new debt.

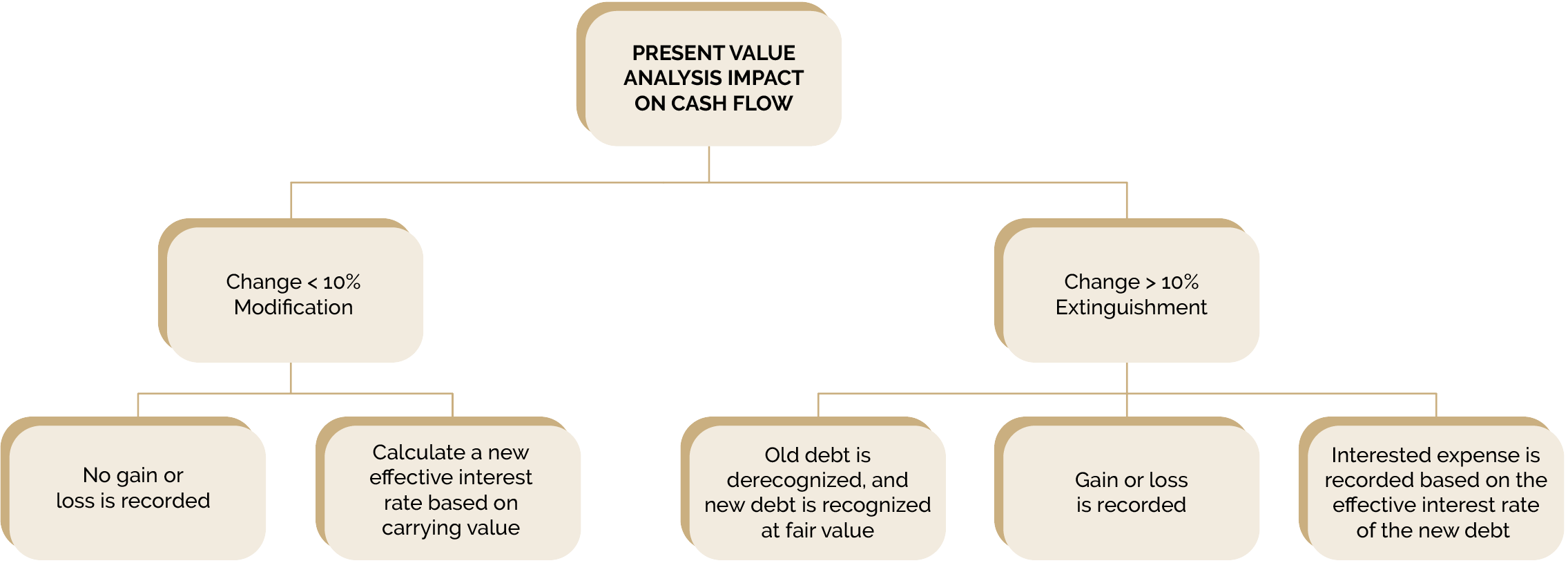

For debt restructuring with the same original lender, one must determine if the restructured debt is considered a modification or an extinguishment. This decision is based on the economic substance of the transaction, regardless of the entity’s legal form. To figure this out, calculate the present value to determine the change in contractual cash flow.

Before calculating, understand that present value analysis has several nuances that can change the cash flow to be considered. For example, are there changes in principal amounts that should be treated as day one cash flows? Can the debt be prepaid? If so, then a separate cash flow analysis would need to be performed, assuming whether prepayment is exercised or not, and the scenario with the smaller change would be used. Once the present value analysis is complete, if the change in cash flows is 10% or greater, the restructuring is accounted for as an extinguishment. If the change in cash flows is less than 10%, the restructuring is considered a modification.

Accounting Treatment for Debt Modification and Extinguishments

A modification, cashflow change less than 10%, gain or loss is not recorded, and a new effective interest rate is calculated based on the carrying value of debt and revised cash flow. For an extinguishment, cashflow change greater than 10%, the old debt is derecognized, and the new debt is recognized at fair value, a gain or loss is recorded, and the interest expense is recorded based on the effective interest rate of the new debt.

Interested expense is recorded based on the effective interest rate of the new debt

The accounting treatment for new and old fees incurred differs between a modification and an extinguishment. If categorized as a modification, the original cost will continue to be amortized over the modified term of the loan, the fees paid to the lender will be capitalized and amortized over the modified loan term, and any fees paid to third parties will be expensed. If the transaction is an extinguishment, original costs get written off, fees paid to the lender are expensed as part of the loss on extinguishment, and fees paid to third parties are capitalized and amortized.

Considerations for Debt Modifications and Restructurings

When going through or considering completing a debt modification or restructuring, there are several questions to consider, including:

- Are all debt covenants being met?

- Has liquidity been impacted negatively?

- What is the timing of the debt-related transactions?

- Did anything happen after year-end but prior to the audit issuance to determine if any subsequent events have any impact that needs to be reflected or disclosed within the balance sheet? Seeking Professional Guidance

As organizations continue to face economic uncertainty today, real estate owners should assess their debt to identify loans coming due, debt modification and restructuring options, and the proper accounting treatment for each specific case. If you have debt modification questions, please contact our team using the form below.

What's on Your Mind?

Start a conversation with the team