The Silver Lining: IPO Trends in Technology and Life Sciences in 2024

- Published

- Aug 5, 2024

- Topics

- Share

The U.S. life sciences and technology industries experienced robust growth in the first half of 2024, driven by a rebound in the number of initial public offerings and increased investor optimism following a slow 2023. The positive trends in both industries suggest a dynamic and promising second half of the year.

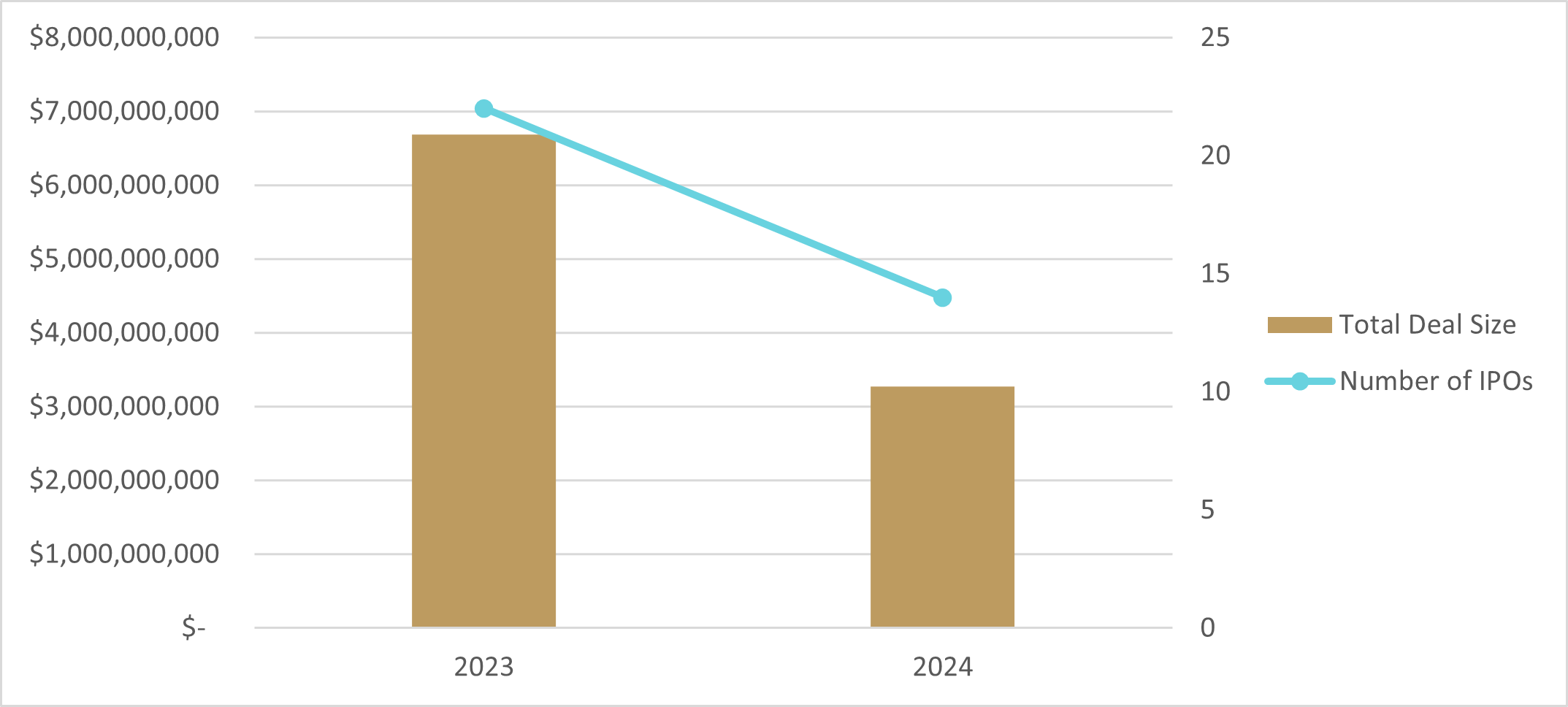

The technology industry in the U.S. has continued to innovate, with a particular focus on artificial intelligence (“AI”), cloud computing and cybersecurity but there has been a mixed bag in terms of funding, according to Stock Analysis.1 The venture capital markets have remained quiet in 2024 as interest rates and the high cost of capital have fostered investors to be more selective in how they choose to deploy their capital and to be more risk-averse. Meanwhile, the number of technology IPOs in the first half of 2024 has increased compared to the first half of 2023. Through June 30, 2024, there were already 14 technology IPOs; in 2023 when there were only nine in the first half of the year and 22 total, with the application and infrastructure software segments leading the charge. However, the average deal size of technology IPOs has declined from approximately $304m in 2023 to $234m in 2024.

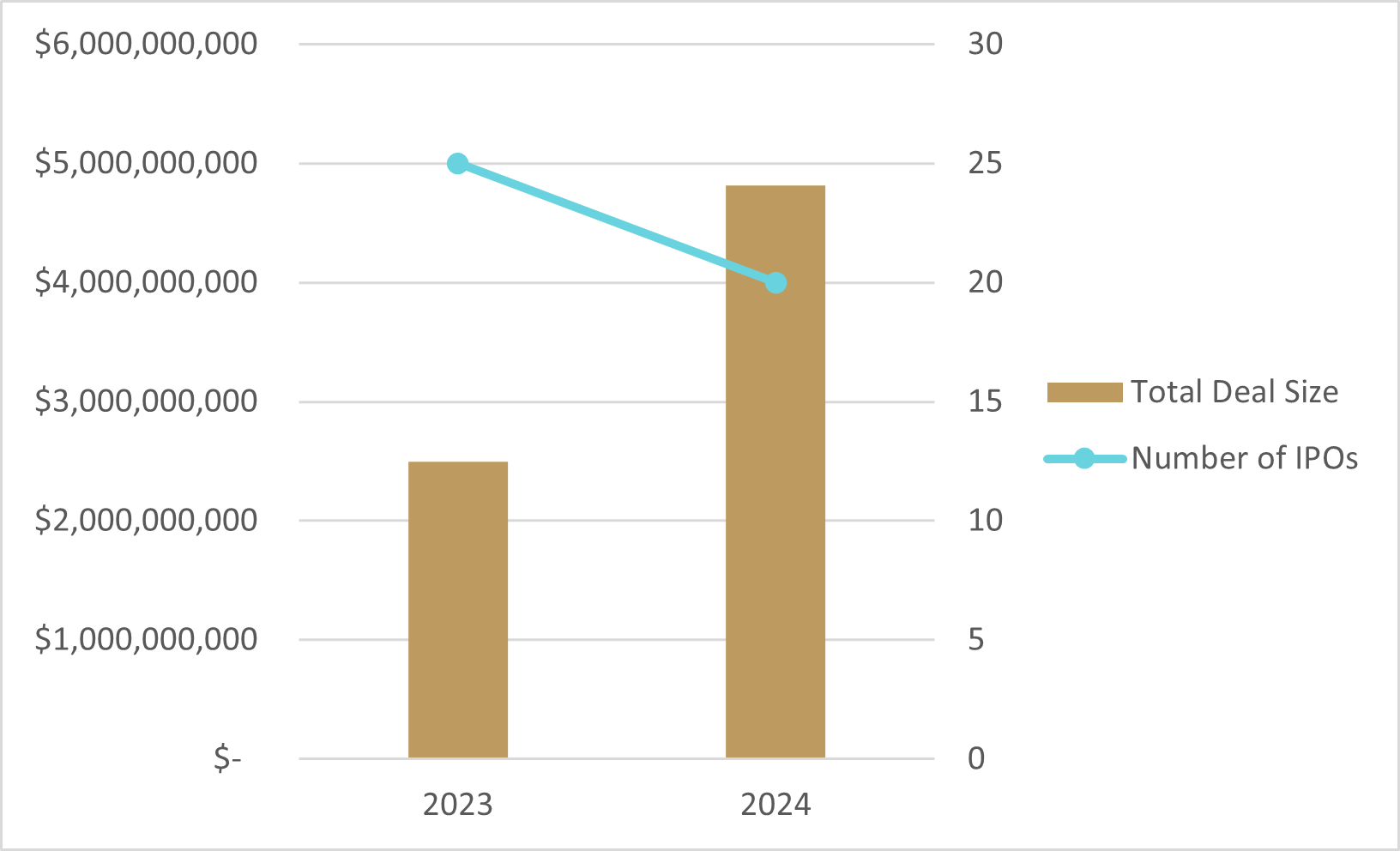

The life sciences industry in the U.S. has experienced growth and innovation, driven by a focus on new drug development while advances in cell and gene therapy draw interest in the market -- but these technologies are still at an early stage of development, according to Stock Analysis. The amount of life science venture capital deals has declined in 2024 compared to the first half of 2023 but the average deal size is higher in 2024 as current market conditions caused the need to focus on less risky investments that depend on significant future growth. The canyon between the “haves” and “have nots” appears to be getting more pronounced. In the IPO market for life science companies, there has been an increase in the number of IPOs as well as the average deal size, due to a significant focus in the biotechnology segment. In the first half of 2024, there has already been 20 life science companies that have completed an IPO with an average deal size of $241 million), compared to 25 life sciences companies that completed an IPO in all of 2023, with an average deal size of $100m.

Looking ahead, the life sciences and technology markets are poised for robust growth, demonstrated by the increase in IPOs in both sectors in 2024 compared to 2023. Innovation is at an all-time high, driven by AI and new/deep technologies. With the higher interest rates and inflationary environment at this time, investors have looked for more secure returns on their investments but if the interest rates in the U.S. drop in the second half of 2024, investors may use their excess capital to fund the life science and technology companies that have slowed down over the last few years. However, uncertainty regarding the upcoming U.S. presidential election and its effect on the market is likely to slow down funding until the fall. The IPO market is likely to stay active, with more companies leveraging the stabilizing macroeconomic conditions to go public. The IPO pipeline looks strong, and companies that postponed going public in previous years may seize the opportunity presented by the current favorable conditions. In addition, with technology and life sciences companies’ need for additional financing to sustain operations and prepare for growth, there may be a rise of SPACs or reverse mergers with publicly traded companies as an alternative to IPOs.

What's on Your Mind?

Start a conversation with Eli